Client Money Audit

What is the Client Money Audit?

Why Choose This Audit?

What's Included

A clear, independent review of your client account activity, including:

- Full breakdown of client money activity

- Compliance snapshot

- Categorisation of transactions

- High-value transactions flagged for review

- Month-on-month comparison

- Summary of patterns or trends outside normal activity

- Unusual or unexpected transactions flagged for review

- TLP Assured certificate and window sticker

Typical Timeline

Questionnaire: 30minutes

Audit Processing: Up to 5 working days

Receive Your Results

Frequently Asked Questions

-

What is the Client Money Audit?+ -

The Client Money Audit is a detailed, transaction level review of how your client accounts are operated. It ensures compliance with relevant regulations and Client Money Protection (CMP) scheme expectations, while also identifying anomalies, risks and opportunities to strengthen your controls. The audit is designed to provide transparency and assurance, helping to protect landlords, tenants and your business.

-

What do I need to do to complete the audit?+ -

You complete our online questionnaire, which typically takes around 30 minutes. The form will guide you step by step and prompt you to upload the required documents.

-

What sort of information will I have to provide in the questionnaire?+ -

You'll be asked to provide:

- Number of rents collected

- How deposits are calculated and handled

- Details of your professional indemnity insurer

- Your Client Money Protection (CMP) scheme

- Number of new lets in the last 90 days

-

What documents do I need to send?+ -

The online form will prompt you to upload:

- A screenshot of the Summary Page from your deposit protection provider

- A letter from your bank confirming that your client account(s) are ring-fenced

- 3 months' bank statements for all client accounts, provided securely via Open Banking

-

How much does the Client Money Audit cost?+ -

The audit costs £140 + VAT

-

How and when do I make payment?+ -

Once you submit the completed questionnaire and upload your documents, you'll be automatically directed to the payment page.

-

How long does the audit take?+ -

After all information is received and payment made, we aim to deliver the final report within five working days, provided there are no queries during the review.

-

What makes the Client Money Audit different from an accountant audit?+ -

Unlike most accountant-led audits, the Client Money Audit reviews every transaction. Each entry is categorised (rents, deposits, fees, payments, etc.) and analysed against industry norms. This approach enables far more accurate identification of unusual activity, imbalances or emerging risks.

-

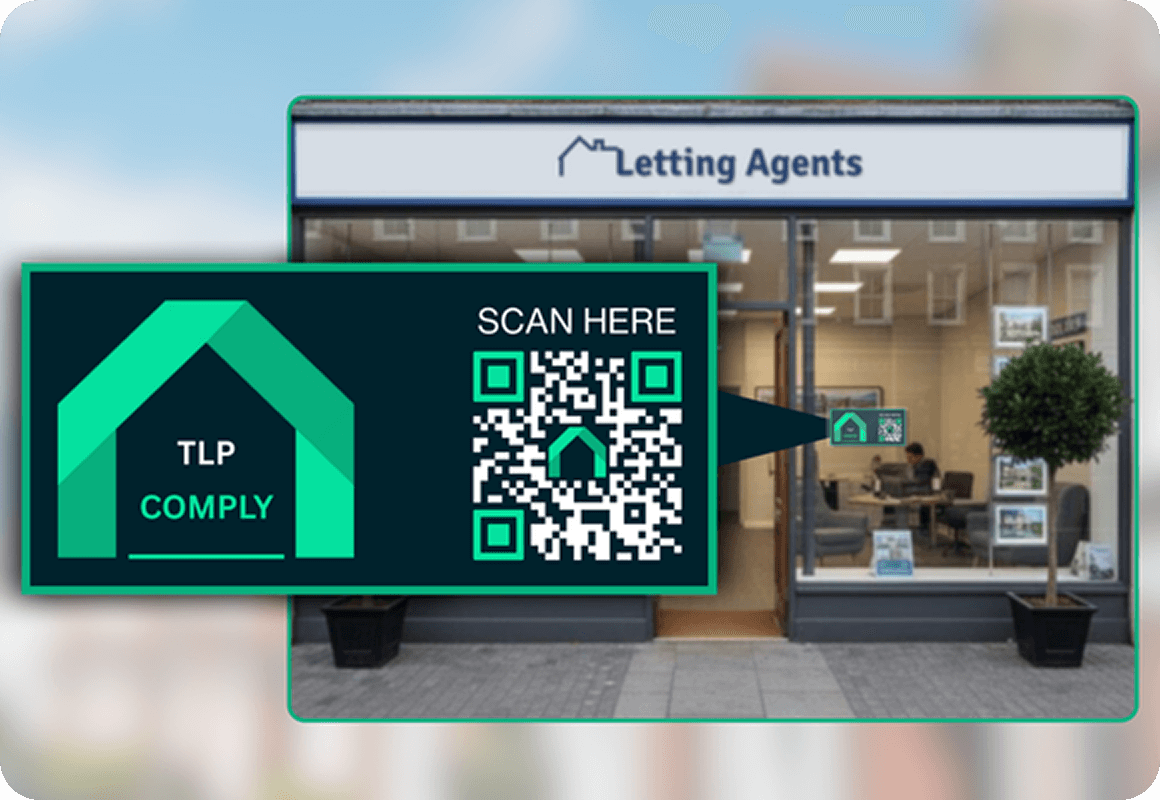

What is TLP Assured status?+ -

Agents who successfully complete the Client Money Audit achieve TLP Assured status. This provides independent confirmation to landlords and tenants that your client money handling has been reviewed against recognised standards and best practice.

-

What do I receive when I become TLP Assured?+ -

TLP Assured agents receive:

- Inclusion on our publicly available TLP Assured agent map

- A TLP Assured window sticker for in-branch display

- A Certificate of Assurance for use in your office and on your website (if you wish)

This allows you to demonstrate transparency and reassurance to landlords, tenants, and other stakeholders.

-

How many agents are TLP Assured?+ -

By becoming TLP Assured, you join thousands of letting agents across the UK who have chosen independent oversight of their client money handling.

-

Is this the audit I need to renew my CMP insurance?+ -

Audit requirements vary by scheme and as such, if you are completing an audit specifically for CMP insurance renewal purposes, you should visit our CMP Audit page and follow the links from there.

-

What is Open Banking, how secure is it, and why is it better than emailing statements?+ -

Open Banking is a government-backed initiative that allows secure sharing of bank transaction data with regulated third parties, such as GoCardless. Key benefits:

- More secure: No sensitive files sent via email

- More accurate: Data comes directly from your bank

- More efficient: Automatic data retrieval speeds up the audit process

You remain in control. Access is temporary, and you choose what information to share.

-

What happens if anomalies or discrepancies are found?+ -

If any unexplained payments or figures outside industry norms are found, we'll contact you for clarification before issuing the final report. One-off issues usually don't affect the outcome. Recurring patterns are noted in the report for transparency.

-

What if I know my client account has a problem before the audit, or one is flagged during the process?+ -

Our audits are designed to help, not to penalise.

- If you're aware of an issue, inform us. Our expert team can advise on the best way forward.

- If a problem arises during the audit, we can support resolution.

Hands-on remedial work is available address issues and strengthen processes.